AI Solutions for Banking & Finance

Customize AI to streamline workflows, enhance risk assessment, and unlock deeper insights for better decision-making.

Solving Challenges in Finance with AI

As the financial industry adapts to new demands, banks and financial institutions face challenges such as managing large volumes of data, delivering rapid and personalized customer experiences, and complying with evolving regulations. AI in banking helps address these pain points by streamlining operations, improving accuracy, and meeting client expectations

Fraud Protection & Prevention

Fraud costs banks around $42B annually. AI in finance analyzes transaction data in real time to detect suspicious activities, reducing the risk of fraud and financial loss.

Loan & Credit Scoring

Loan approvals can take up to 15+ days manually. AI in financial analysis speeds up loan approvals by assessing creditworthiness through advanced analytics, improving accuracy and reducing manual errors.

Customer Service & Support

Financial institutions see a 35% rise in stress from workload. AI chatbots for banking provide 24/7 support, handling customer queries and reducing workload for human agents.

Risk Management

Banks spend up to 20% more time on manual data analysis. AI in risk management uses historical data and market trends to assess risks, enabling informed decisions and reducing manual analysis time.

Personalized Financial Services

Personalized services can increase revenues by 10-30%. AI in banking analyzes customer data to deliver personalized financial advice and product recommendations, increasing loyalty and satisfaction.

Compliance with Evolving Regulations

Financial firms report a 12% average rise in compliance costs. AI for compliance in finance automates transaction monitoring and adapts to regulatory updates, reducing manual errors and compliance costs.

Solving Challenges in Finance with AI

As the financial industry adapts to new demands, banks and financial institutions face challenges such as managing large volumes of data, delivering rapid and personalized customer experiences, and complying with evolving regulations. AI in banking helps address these pain points by streamlining operations, improving accuracy, and meeting client expectations

Fraud Protection & Prevention

Fraud costs banks around $42B annually. AI in finance analyzes transaction data in real time to detect suspicious activities, reducing the risk of fraud and financial loss.

Loan & Credit Scoring

Loan approvals can take up to 15+ days manually. AI in financial analysis speeds up loan approvals by assessing creditworthiness through advanced analytics, improving accuracy and reducing manual errors.

Customer Service & Support

Financial institutions see a 35% rise in stress from workload. AI chatbots for banking provide 24/7 support, handling customer queries and reducing workload for human agents.

Risk Management

Banks spend up to 20% more time on manual data analysis. AI in risk management uses historical data and market trends to assess risks, enabling informed decisions and reducing manual analysis time.

Personalized Financial Services

Personalized services can increase revenues by 10-30%. AI in banking analyzes customer data to deliver personalized financial advice and product recommendations, increasing loyalty and satisfaction.

Compliance with Evolving Regulations

Financial firms report a 12% average rise in compliance costs. AI for compliance in finance automates transaction monitoring and adapts to regulatory updates, reducing manual errors and compliance costs.

Solving Challenges in Finance with AI

As the financial industry adapts to new demands, banks and financial institutions face challenges such as managing large volumes of data, delivering rapid and personalized customer experiences, and complying with evolving regulations. AI in banking helps address these pain points by streamlining operations, improving accuracy, and meeting client expectations

Fraud Protection & Prevention

Fraud costs banks around $42B annually. AI in finance analyzes transaction data in real time to detect suspicious activities, reducing the risk of fraud and financial loss.

Loan & Credit Scoring

Loan approvals can take up to 15+ days manually. AI in financial analysis speeds up loan approvals by assessing creditworthiness through advanced analytics, improving accuracy and reducing manual errors.

Customer Service & Support

Financial institutions see a 35% rise in stress from workload. AI chatbots for banking provide 24/7 support, handling customer queries and reducing workload for human agents.

Risk Management

Banks spend up to 20% more time on manual data analysis. AI in risk management uses historical data and market trends to assess risks, enabling informed decisions and reducing manual analysis time.

Personalized Financial Services

Personalized services can increase revenues by 10-30%. AI in banking analyzes customer data to deliver personalized financial advice and product recommendations, increasing loyalty and satisfaction.

Compliance with Evolving Regulations

Financial firms report a 12% average rise in compliance costs. AI for compliance in finance automates transaction monitoring and adapts to regulatory updates, reducing manual errors and compliance costs.

Delivering Real Business Growth

In the banking and finance sector, our AI solutions help enhance operational efficiency and security, while delivering superior customer experiences. Through AI, we empower institutions to achieve their business goals and drive sustainable growth.

Client Retention Rate

Customer Satisfaction Rate

Successful Project

Implement Intelligent Finance Models with AI Solutions

Explore our AI solutions for banking and finance, designed to enhance security, customer experience, and operational efficiency.

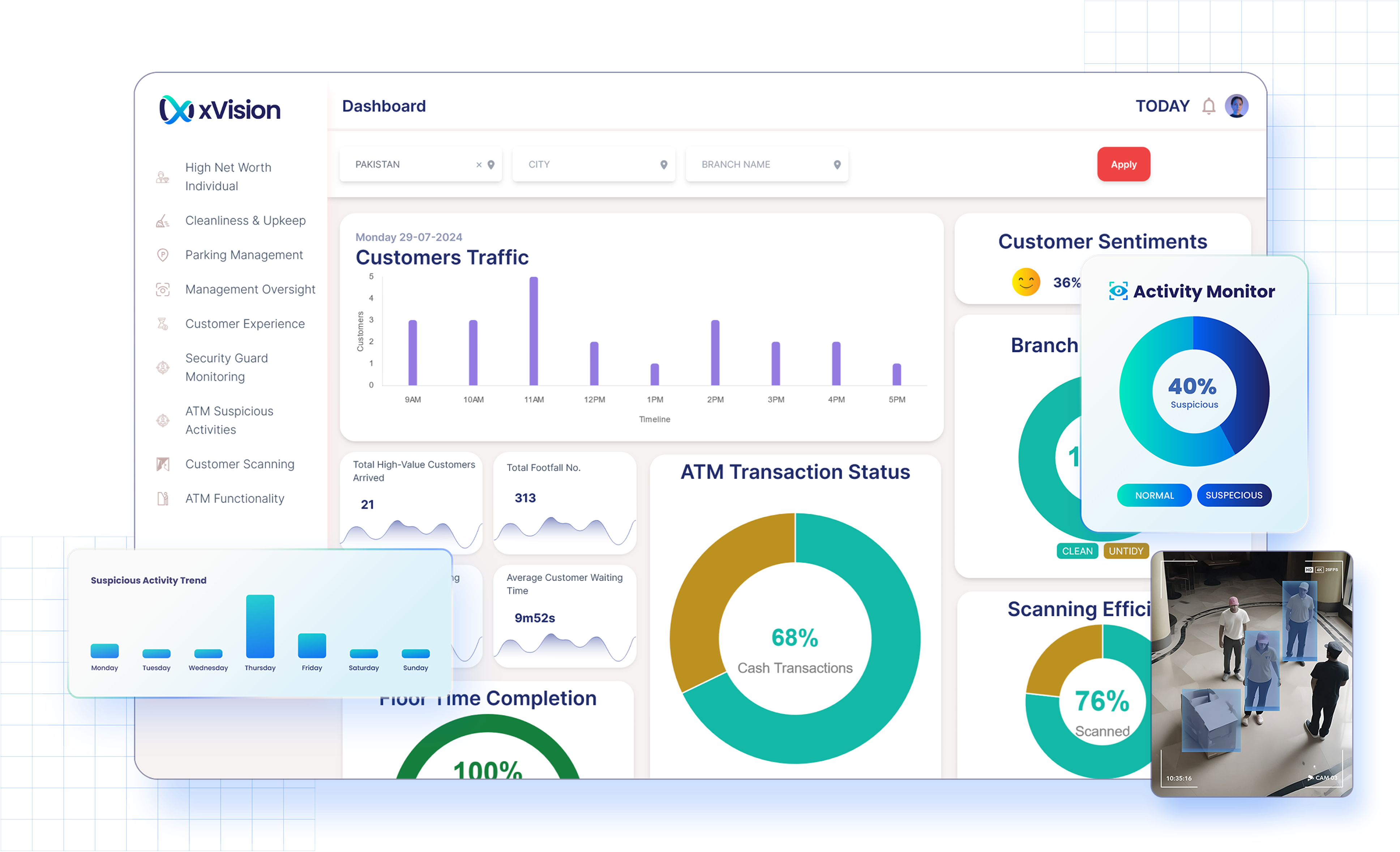

Enhance security & improve customer experience.

Our AI-powered computer vision solution delivers real-time threat detection for improved security, high-value client recognition to personalize service, intelligent queue management for smoother customer flow, and comprehensive environmental monitoring for operational efficiency.

Benefits of AI in Banking & Finance

Discover the potential of AI to create data-driven value and streamline workflows.

Enhanced Process Efficiency

Automate and optimize procurement, billing, financial analysis, and planning with AI in finance.

Comprehensive Operational Overhaul

Integrate AI in banking to transform workflows and increase overall efficiency.

Superior Customer Experience

AI in banking delivers personalized services, faster support, and innovative financial products.

Strengthened Compliance & Risk Management

AI in risk management and compliance reduces disruptions and ensures regulatory standards are met.

Data-Driven Value Creation

AI in financial analysis increases ROI and productivity with unified data and automation platforms.

Enhanced Process Efficiency

Automate and optimize procurement, billing, financial analysis, and planning with AI in finance.

Comprehensive Operational Overhaul

Integrate AI in banking to transform workflows and increase overall efficiency.

Superior Customer Experience

AI in banking delivers personalized services, faster support, and innovative financial products.

Strengthened Compliance & Risk Management

AI in risk management and compliance reduces disruptions and ensures regulatory standards are met.

Data-Driven Value Creation

AI in financial analysis increases ROI and productivity with unified data and automation platforms.

Some Cool Stuff

We've Built

xVision: Where Visual Data Becomes Strategic Advantage

View Case Study

FAQs

Frequently Asked Questions

NLP Advancements: Enhancing Customer Experiences in the Age of AI

Why Most Enterprise AI Projects Stall After the Pilot (And How to Fix It)

Building Scalable AI Infrastructure: Lessons from Real-World Implementations

The Future of AI in Digital Transformation: Key Strategies for 2026

AI in Retail: From Personalization to Inventory Optimization

The Business Case for Synthetic Data: Real-World Use Cases Driving Enterprise AI Success

NLP Advancements: Enhancing Customer Experiences in the Age of AI

Why Most Enterprise AI Projects Stall After the Pilot (And How to Fix It)

Building Scalable AI Infrastructure: Lessons from Real-World Implementations

The Future of AI in Digital Transformation: Key Strategies for 2026

AI in Retail: From Personalization to Inventory Optimization

The Business Case for Synthetic Data: Real-World Use Cases Driving Enterprise AI Success